Compare Year-End Payslip to W-2

Understanding the difference between the year-end payslip and the W-2 can be confusing if you are not familiar with payroll and taxes. To help, you may want to review the training guides on How to Read your Payslip and How to Read your W-2.

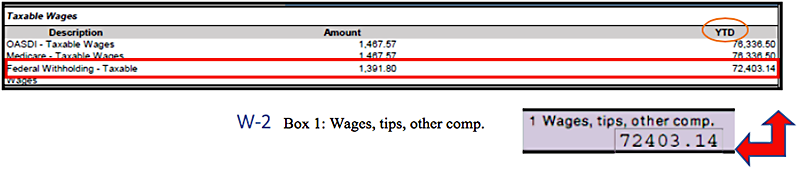

Payslip Taxable Wages (Federal Withholding – Taxable)

W-2 Box 1: Wages, tips, other compensation

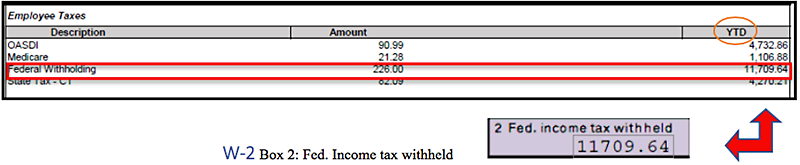

Payslip Employee Taxes (Federal withholding)

W-2 Box 2: Fed. Income tax withheld

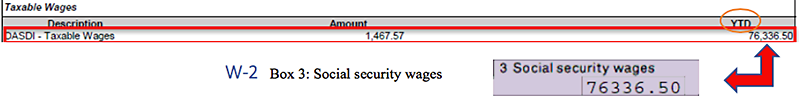

Payslip Taxable Wages (OASDI)

W-2 Box 3: Social security wages

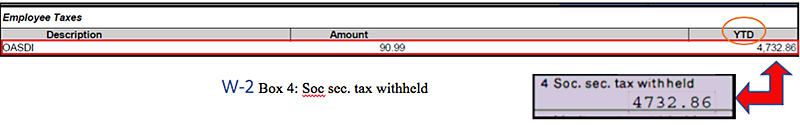

Payslip Employee Taxes (OASDI)

W-2 Box 4: Soc sec. tax withheld

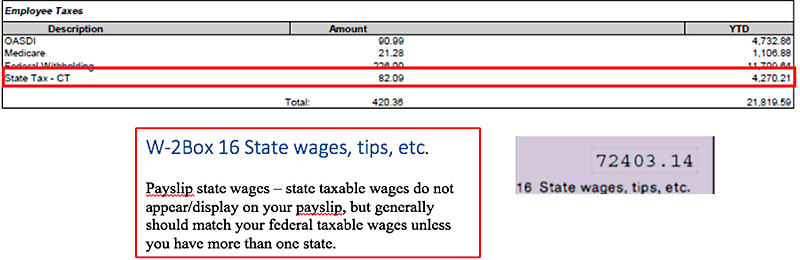

Payslip Employee Taxes (State Tax - CT)

W-2 Box 16 State wages, tips, etc.

Payslip state wages – state taxable wages do not appear/display on your payslip, but generally should match your federal taxable wages unless you have more than one state.

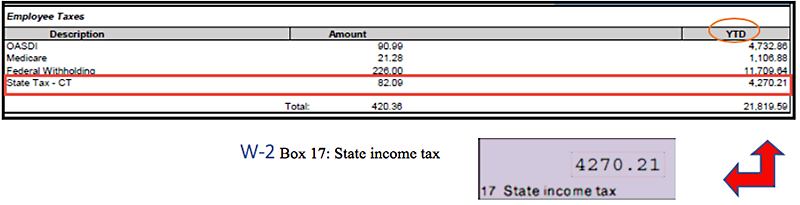

Payslip Employee Taxes (State Tax – CT)

W-2 Box 17: State income tax

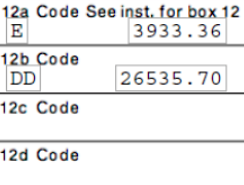

Box 12 - Elective deferrals

Boxes 12a through 12d will list various items, such as your pre-tax contributions to Yale’s 403(b), nontaxable sick pay or other excludable pay. Below are the most common codes used by Yale.

- Code E-elective deferrals under a 403(b)-salary reduction agreement.

- Code DD – Cost of employer-sponsored health coverage. This amount is not taxable.

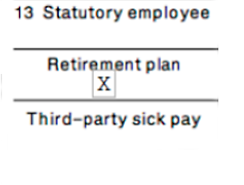

Box 13

One box within this section will be checked if it applies to you: statutory employee, retirement plan or third-party sick pay. For Yale employees, the retirement box is checked if you are eligible for any University paid retirement plan or you have participated in a salary reduction arrangement under 403(b) or 457. If the retirement plan box is checked, it signifies limits on the amount of IRA contributions you may deduct.