We want to hear from you! Take the survey.

How do you use It’s Your Yale? How can it be improved? Answer for a chance to win Yale swag.

Form 1042-S

What is form 1042-S?

Yale University will issue a 1042-S annually to report any non-resident alien wages and tax withholdings. Form 1042-S may include payments from various departments such as (Payroll, AP, Banner, Yale Press). Form 1042-S is issued to certain non–U.S. citizen students who have received scholarships in excess of their tuition and required fees or if they have received other reportable payments from the University. Form 1042-S reports the required 14% or 30% tax withheld on such excess scholarships or payments. The form is mailed March 15, to the student’s billing address on file in the Student Information System (now Yale HUB) All others are sent to the address on file in Workday, A/P or Yale Press. (If there is no billing address on file, the form is mailed to the student’s permanent address; if no permanent address is on file, the form is mailed to the student’s mailing address in SIS.) The 1042-S forms are also available online through the Foreign National Information System (FNIS) website to students who have a FNIS account. Students can also request a copy of Form 1042-S by contacting the Finance Support Center (FSC) at (203) 432-5394 or by emailing askfinance@yale.edu.

For any questions regarding your 1042-S, please contact the Finance Support Center at 203-432-5394 or askfinance@yale.edu.

For any questions regarding your residency status, please contact the International Tax Department at internationaltax@yale.edu.

Why did I receive a 1042-S?

Yale University will issue a 1042-S (Foreign Person’s U.S. Source Income Subject to Withholding) to any Non-Resident Alien to report any payments and tax withholdings.

Why did I receive multiple copies?

- Copy B: Recipient copy

- Copy C: Filed with federal tax return

- Copy D: Filed with state tax return

What are the different fields on form 1042-S?

Unique Form Identifier: Yale University will automatically provide a mandatory unique 10-digit numerical identifier on each 1042-S that is filed.

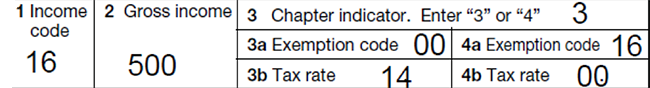

Box 1 Income Code: Is a two-digit numerical code used by the U.S Internal Revenue Service (IRS) to identify the type of income that was paid to you. Yale University uses the following income codes:

- 16- Scholarships and fellowship grants

- 17- Compensation for independent personal services (Independent contractor, Honorarium)

- 18- Compensation for dependent personal services

- 19- Compensation for teaching

- 20- Compensation during studying and training

- 23- Other income (Awards and Prize payments)

Box 2 Gross Income: The total amount of the income that was paid to you. This figure will be the total gross income paid by Yale University.

Box 3 Chapter Indicator: Yale University uses Chapter 3, this determines the tax rule applicable to your payment.

Box 3a Exemption code: 00 Indicates that the payments received from Yale University were not exempt from federal income tax withholding. 04 indicates that the payments received from Yale University were exempt from federal income tax withholding.

Box 3b Ch. 3 Tax rate: If your exemption code in Box 3a is 00 this will display a 14 or 30 percent. If Box 3a displays a 04, this indicates you are tax exempt under your treaty and will display 0.

Box 4a Exemption code: Yale University only uses exemption code 16, which is for excluded non-financial payments, including wages, scholarships, honoraria, and awards/prizes.

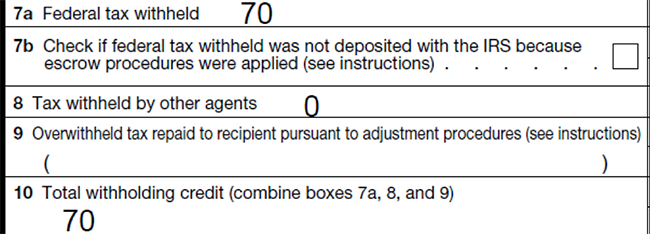

Box 7 Federal Tax Withheld: Yale University will calculate your total federal income tax withheld by taking the total gross income in box 2 and multiplying it by your assigned tax treaty rate in box 3a,3b. This figure will match your last pay statement and display as “federal withholding income code 16”.

Box 8-9 Tax withheld by other agents & tax paid by withholding agent: Not applicable for Yale University payments.

Box 10 Total withholding credit: Total amount of federal income tax that was withheld from the gross payment. This figure will always match your total federal tax withheld in Box 7a, in addition to your last pay statement which will display as “federal withholding income code 16”.

Box 11: Amount repaid to recipient: Not applicable to Yale University.

Box 12a: Withholding agent’s EIN: Yale University’s Federal Tax Identification Number.

Box 12b: Ch. 3 status code: 02: Yale University uses 24, “Section 501 (c) entities”

Box 12c: Ch. 4 status code: 02: Yale University uses 24, “Section 501 (c) entities”

Box 12h- 12i: Withholding agent’s name and address: This box will display Yale University and P.O. Box 208356 New Haven, CT 06520-8356

Box 13a – 13K: Recipients name, address, country code, and ITIN or SSN: This will display your name, address, country code and ITIN (International Tax Identification Number) or SSN (Social Security Number).

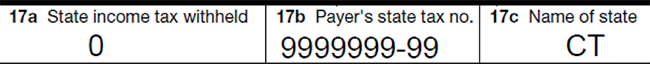

Box 17a: State income tax withheld: Not applicable for Yale University payments.

Box 17b: Payer’s state tax no: Yale University’s Connecticut State Tax Identification number.

Box 17c: Name of State: CT (Connecticut)