We want to hear from you! Take the survey.

How do you use It’s Your Yale? How can it be improved? Answer for a chance to win Yale swag.

Form 1099-Misc

What is form 1099-Misc?

Yale University will issue a form 1099-MISC annually to report non-employee compensation (Post Doc Fellowships (PDF).

You can confirm the accuracy of your 1099-MISC by referencing your last pay statement and comparing it to your 1099 (Applicable for Payroll issued 1099-MISC’s only).

Payroll department issued 1099-MISC’s will be post marked via U.S mail by January 31st.

Yale does not withhold taxes on non-employee compensation.

You have the option to setup Estimated Quarterly Tax Payments with the IRS. For additional information please reference this IRS guide.

For any questions regarding your 1099-MISC please contact the Finance Support Center at 203-432-5394 or askfinance@yale.edu.

Why did I receive multiple copies?

- Copy B – Recipient copy received by January 31st.

- Copy 2- Receipt copy that is used to submit with individual state income tax return when required.

What is contained in the boxes on the form?

- Box 1 (Rents) - Report rents from Real Estate. This box reports any rental payments received from Yale University Accounts Payable.

- Box 2 (Royalties) - Report royalties on copyrights and patents. This box reports any royalty payments received from Yale University Accounts Payable.

- Box 3 (Other income) - This box includes any payments received as the beneficiary of a deceased employee, prizes, awards, or other taxable income. For Payroll issued 1099’s, this box will include your annual PDF (Post Doc Fellowship) and PDF Sub income.

For Accounts Payable issued 1099’s, this box will include any payments related to prizes/awards, stipends, and fellowship/grants. - Box 4 (Federal income tax withheld) - This box shows backup withholding where applicable. Generally, Yale University must backup withhold federal income tax at a rate of 24% if you did not furnish your Tax Identification Number. In most cases, this box will be blank and you will responsible for paying your federal income taxes when filing your 1040 form.

- Box 6 (Medical and health care payments) – This Box reports any payments to a medical professional exceeding $600. This figure will report any medical or health payments received from Yale University Accounts Payable.

- Box 7 (Non-employee compensation) – This box reports any amounts exceeding $600 paid to Independent contractors. This figure will include any payments received related for services and Honorarium from Yale University Accounts Payable.

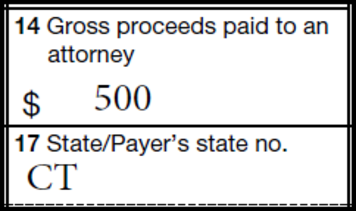

- Box 14 (Gross proceeds paid to an attorney) - Report any amounts of $600 or more paid to an attorney for legal services. This box will report any payments issued by Yale University Accounts Payable for any legal services provided to the University.

- Box 17 (State/Payer’s state no.) - This is Yale University’s Connecticut State Tax Identification number.

Note: The fields below are NOT applicable to Yale-issued 1099’s

- Box 5 (Fishing boat proceeds)- This box is not applicable for Yale University payments.

- Box 8 (Substitute payments in lieu of dividends or interest) – This box is not applicable for Yale University payments.

- Box 9 (Payer made direct sales of $5000 or more of consumer products to a buyer (recipient) for resale)- Check this box if this situation applies to you. This box is not Applicable for Yale University payments.

- Box 10 (Crop insurance proceeds) - Report insurance payments exceeding $600 made to a farmer. This box is not applicable for Yale University payments.

- Box 13 (Excess golden parachute payments) – Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. This box is not applicable for Yale University payments.

- Box 15a (Section 409A deferrals)- completing this box is optional. This box is not applicable for Yale University payments.

- Box 15b (section 409A income) – Report business deferred payments that would normally would be classified as section 409A income but wasn’t due a nonqualified deferred compensation plan failed to satisfy the requirements of section 409A. This box is not applicable for Yale University payments.

- Box 16 (State tax withheld)- report any state tax withheld from payments. This box is not applicable for Yale University payments.

- Box 18 (State income) -Shows state subject taxable income. Any Yale University payments that are taxable for Connecticut state income taxes will be reported here, not applicable in most cases.