We want to hear from you! Take the survey.

How do you use It’s Your Yale? How can it be improved? Answer for a chance to win Yale swag.

3215 PR.02 Yale Expense Management (PCard and Out-of-Pocket Expenses)

Revision Date:

January 9, 2020

Contents

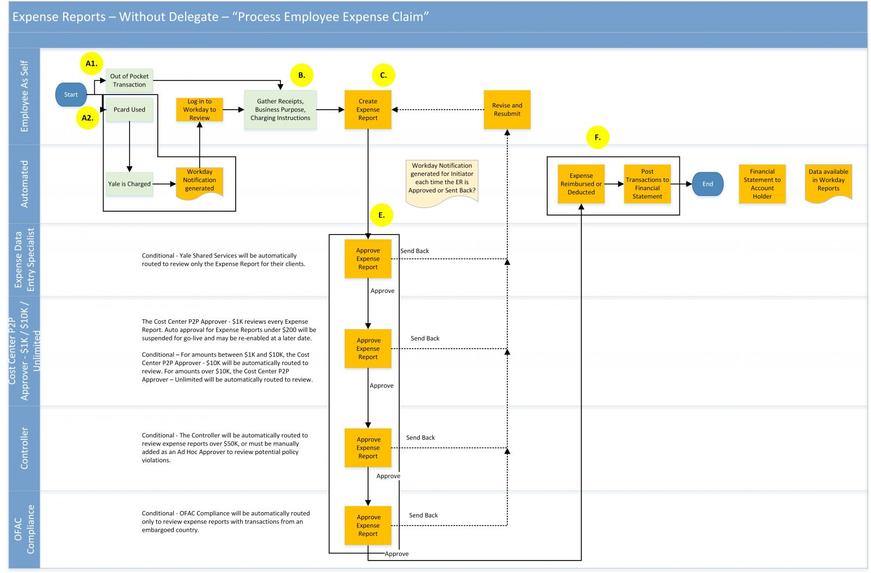

4. Business Process Map: Process Employee Expense Reports

Yale’s Expense Management Solution (Workday Expenses)

Yale’s expense management solution (Workday Expenses) should be used to submit expense reports for PCard and out-of-pocket expenses incurred while conducting University business. Individuals in the following job categories may be authorized to use Yale’s expense management solution: Faculty (FAC), Management & Professional (M&P), Clerical Technical (C&T), Service Maintenance (S&M), Student Non-Hourly (STN), Student Hourly (STH), Casual (CAS), Postdoctoral Associates (PDA), Postdoctoral Fellows (PDF), and Retirees (RET).

Other job categories such as Associates (ASSO), Consultants (CON), Fellows (FEL), Volunteer Faculty (VF), and Students other than noted above should be reimbursed for University business expenses via the Workday Create Supplier Invoice Request (formerly Check Request) process.

Yale’s expense management solution is used in conjunction with a Yale Purchasing Card (PCard) to process PCard transactions. In cases where personal funds are used, Yale’s expense management solution is used to process the individual reimbursement and issue payment. Expenses associated with grants and contracts may be subject to additional restrictions not specifically covered in this procedure. Expenditures must be reasonable and appropriate to the situation and nature of the business conducted by schools and departments and in accordance with this procedure.

Individuals are expected to prepare and submit expense reports, with supporting documentation, within thirty (30) days from the date the expense is incurred.

Yale’s expense management solution and the Yale Purchasing Card provide the following benefits:

- One card for travel and purchasing supplies;

- Minimal use of personal funds, (out-of-pocket (OOP)), because purchasing card charges are paid by the University; and

- Reduced need for travel advances.

The Chief Procurement Officer has responsibility for the systems, processes, effectiveness, and efficiency of purchasing activities at the University.

Procurement - Central process owner for purchasing card program (with oversight from the Controller) and expense reporting system. Responsible for monitoring the issuing (with proper approval from business office/shared service office), use, suspension and termination of PCards. Also, responsible for training all faculty and staff on proper use of PCards and Workday Expenses.

Business Offices - Responsible for maintaining a sound and adequate system of internal controls surrounding the use of and approval process of various purchasing card and out-of-pocket business transactions.

Controller - Approves all exceptions and, where necessary, delegates authority normally performed by the Controller. Consults with eCommerce on monitoring the use, suspension and termination of PCards.

University Auditing - Responsible for performing quality assurance reviews of PCard and out-of-pocket transactions.

Yale’s Expense Management Solution - Includes the processing, creation and submission of expense reports for the following expenditures: travel expenses, reimbursements for materials or supplies purchased with or without a PCard, out-of-pocket reimbursements, or requests for cash advances.

Steps for Processing Employee Expenses: Employee Processing

Steps for Processing Employee Expenses: with Delegate Processing

Processing Employee Expense Reports

Note: Sections A through F below explain the expense process map steps A through F above for processing employee expense reports with and without a delegate.

A1. Out-of-Pocket Expenses (OOP)

If the traveler is using personal funds to purchase airfare, conference fees, etc. that require booking far in advance, the traveler does not have to wait until the completion of the trip to submit these expenses. These types of expenses may be submitted at the time they are incurred.

Individuals traveling on leave for extended periods of time (60 days or more) must submit expenses periodically to ensure compliance.

Note: Out-of-pocket or personal travel expenses 120 days through 366 days from the date incurred are reimbursed as taxable income to the employee (see Form 3215 FR.09 120-366 Day Taxable Expense Reimbursement). Please refer to Policy 3301 Travel on University Business. Gross-up for taxes on this income is not allowed. Expenses greater than 366 days from the date incurred will not be reimbursed.

A2. Notification of PCard Transactions

The cardholder and/or delegate will receive a Workday inbox notification listing each PCard transaction loaded within the previous week. The notification will contain the following information:

- Date of transaction

- Amount of transaction

- Merchant name

Note: To view additional details, hover over Related Actions on the Workday inbox notification.

B. Gather Receipts and Other Requirements for Electronic Submission

Receipts are attached to the expense report at the header or line level. The expense management system requires a receipt only if the line item expense is equal to or greater than $75. Receipts are not required for expenses of less than $75 and do not need to be attached to the expense report nor retained once the expense report is processed. It is a best practice, but not required, for the traveler to submit all receipts even those that are less than $75 to the preparer. Approvers have the right to inquire and review receipts for expenses under $75 in situations that they deem appropriate. After the expense report is processed and appropriate receipts scanned, and the report is approved, all associated receipts should be shredded, except in those cases where the funding source requires all original receipts. Preparers should check all scanned or uploaded attachments to be sure they are legible prior to submitting the report.

Note: If a delegate is submitting the expense report on behalf of an employee (faculty or staff), the employee must provide the receipts, purpose and charging instructions to the delegate.

Receipts can be attached utilizing one of the two processes listed below:

- The report initiator can directly attach the receipt by scanning the receipt to his/her desktop and attaching the scanned receipts to the report; or

- The cardholder may use the Workday mobile application to capture and submit receipts for processing later.

Missing Documentation

If an original receipt is missing for purchasing card transactions of $75 or greater, the individual should request a duplicate receipt from the supplier. In the absence of a duplicate receipt, one of the following alternative documentation methods is acceptable.

- Supplier confirmation via email or fax for the item(s) purchased

- Packing slip delivered with the item(s)

- Completed Form 3301 FR.05 Missing Receipts

Alternative documentation must provide sufficient details to:

- Enable proper classification of expenses.

- Identify unallowable, allocable and reasonable costs for sponsored projects.

Authorization for missing receipts should be an exception, not a general practice. Missing receipts for expenses less than $1,000 must be reviewed and approved by lead administrators or their designees. Employees who frequently fail to submit required receipts should be advised that they are subject to loss of card privileges.

Note: For expenses greater than $1,000, lead administrators should route documentation to the Controller for authorization by selecting the Add Approver function from the approval notification.

The lead administrator or his/her designee has the responsibility to ensure that these guidelines are followed consistently. For specific exceptions or if additional guidance is needed, please contact the Controller’s Office (203-432-5524).

Transaction Disputes

A transaction dispute with a merchant occurs when a cardholder has made a transaction with his/her PCard, but believes that the amount charged was incorrect or not properly credited. In this case, the cardholder should immediately attempt to resolve the dispute directly with the supplier.

If the dispute is not resolved or if the cardholder is unable to contact the supplier directly, he/she should contact JPMorgan Chase within 60 days of the transaction date (1-800-316-6056) to dispute the transaction.

Unrecognized Transactions

PCard transactions that were not authorized by the cardholder are possible fraudulent transactions. However, transactions are sometimes processed under a parent company or associated company’s name. To resolve questions about a purchase, please call the merchant in question directly. If the transaction is still unrecognized follow the steps below:

- The cardholder should notify JPMorgan Chase immediately at 1-800-316-6056 and request the card be canceled and reissued.

- The cardholder will be required to complete and return an affidavit certifying that the transactions in question were not authorized by the cardholder.

- At the end of the bank’s investigation, the bank will issue a communication to the cardholder indicating if funds have been recovered. A credit will be issued for all recovered funds.

- If all funds were recovered, the cardholder should process an expense report with the fraudulent transactions, the corresponding credits, and a copy of the affidavit attached to the expense report.

- If some or all the fraudulent transaction funds were not recovered, please contact the Electronic Commerce Services office (432-3227) for further processing instructions.

Equipment Purchases (MEI Notification)

When a single item of equipment that costs $5,000 or greater and has an expected life of greater than one year is purchased using a Yale Purchasing Card, the charge must be classified and capitalized as part of Movable Equipment Inventory (MEI). In general, these transactions should be purchased via Yale’s e-procurement solution.

C. Complete the Expense Report

Each business expense must be processed via the submission of an online expense report using Yale’s expense management solution (Workday Expenses). An expense report will be considered complete when:

- Information has been entered in all required fields.

- Required supporting documentation (i.e., receipts, itinerary, etc.,) has been attached.

- The expense report has been approved.

Creating and Submitting Expense Reports in Workday

Out-of-Pocket Expenses

- Click Create Expense Report.

- Enter Country of activity and appropriate Charging Instructions.

- Select Mobile Expenses tab and select applicable mobile expenses. Click OK.

- Identify the business Activity in the Business Purpose field

- Use Memo to fully describe the business purpose (who, what, when, where, why).

- Select Expense Report Lines and enter required information.

- Attach receipts from File or Mobile Application.

- Submit to the approver.

Processing PCard Expenses

- Click Create Expense Report.

- Enter Country of activity and appropriate Charging Instructions. Click OK.

- Click PCard Expenses and check items to be included. Click OK.

- Identify the business Activity in the Business Purpose field.

- Use the Memo field to fully describe the business purpose (who, what, when, where, why).

- Select the appropriate Expense Item line and enter required information.

- Attach receipts.

- Submit to the approver.

Note: For further assistance with this process, please consult the Workday@Yale Support webpage or the Finance Support Center (FSC), (203) 432-5394. The following Workday Quick Guides are also available:

- Processing Expenses Incurred by Faculty/Staff

- Create Out of Pocket Expense Report

- Create an Expense Report (video)

- Delegation Settings for Expenses and Spend Authorizations

- Mobile Expense Management

- Create Expense Report for International Expenses

Allowable Expenditures

Transportation (Air, Rail)

If air, rail tickets were directly billed to the department via a Travel Requisition, do not list those items on the ER. Itemize separately the major mode of transportation (unless the expense was directly billed to the University).

If tickets were paid as out-of-pocket expenses, enter the charging instructions and the total reimbursable amount, and all required item details.

Individual Actual Meals

Travelers must choose a single method of expense reimbursement: either actual expenses or per diem expenses, to be used for each trip. Reimbursement should only be claimed when the traveler incurred actual travel-related meal expenses.

Actual expenses:

Reimbursement should be requested for actual personal meal expenses whenever possible.

- Enter the charging instructions and the total actual cost of the meals, as reflected in attached receipts. Receipts are not required for meals less than $75.

There is no requirement to break out alcohol on business meals, but the detailed receipt (including date, amount and place) from the restaurant is still the preferred type of receipt. If the business meal is charged to a federally sponsored award, any alcohol must be identified and classified per the terms and conditions of the award.

Per Diem:

When it is not possible or practical to claim actual meal expenses, the federal published per diem rates for meals and incidental expenses (M&IE) can be claimed for the contiguous United States (domestic) and for international expenses.

The per diem rate should not be used when meals are paid by a host or included in conference registration fees. When travel covers only part of a day, such as the day of departure or return, or if the cost of one or more meals is covered by another source or included in a conference registration fee, use actual expenses or prorate the per diem rate as follows: 20% Breakfast, 30% Lunch, and 50% Dinner.

- Enter Domestic or International Per Diem, the destination, and the number of days claimed, in the item details section. Verify the charging instructions and the total per diem amount claimed. If meals were provided, enter the number provided; the meal expenses will be deducted from the total at the per diem rate noted above.

- Federal per diem rates are updated periodically. Be sure to use the rates in effect on the dates of travel. It may be helpful to attach a copy of the pertinent per diem rate web page. Department business managers are responsible for monitoring correct use of per diem rates.

- Incidental expenses included in the federal M&IE rate are laundry, dry cleaning, and tips for services. When the per diem rate is used, the traveler should not request reimbursement for such expenses separately.

Other Travel Expenses

Travelers may request reimbursement for:

- Laundry services that are reasonable and necessary due to an absence from home for more than five consecutive days or when unusual circumstances mandate these services.

- Costs for laundry and tips for services are included in the per diem rate for meals and incidental expenses. If the per diem rate is used, the traveler should not request reimbursement for such expenses separately.

- Telephone calls or internet services that are reasonable and necessary for conducting University business, and a reasonable number of personal telephone calls that allow travelers to stay in contact with their families.

The following personal expenses incurred while traveling on university business will not be reimbursed: in-room movie rentals, in-room alcoholic beverages and mini-bars, babysitting, recreational activities, and similar expenses.

Note: If these personal expenses are incurred on a PCard, they must be categorized as personal expenses and repayment must be made to the University.

Group Meals and Entertainment

Employees may be reimbursed for a reasonable number of business meals and entertainment events that are appropriate to the situation and the nature of the business conducted by schools and departments (see Policy 3302).

- List each reimbursable business meal or event expense. Enter a brief description of the meal or event, amount, and the charging instructions. There is no requirement to break out alcohol on business meals, but the detailed receipt, if one is required (including date, amount and place) from the restaurant is still preferred. However, if the business meal is charged to a federally sponsored award, any alcohol must be identified and charged appropriately.

Travel Advances

The University issues travel advances only if the traveler is ineligible for the Yale Purchasing Card or when extended travel is involved. For advances on extended travel, refer to Policy 3305 Long Term Activity Expense Advances.

Advance Clearance

Outstanding travel advances are expected to be cleared within two weeks (10 business days) of the traveler’s return by submission of an expense report complete with supporting documentation.

D. and E. Expense Report Approvals:

Expense reports will be automatically routed to the appropriate level approver:

- When prepared by a Delegate, employee cardholders must review and approve the expense report containing out-of-pocket or personal charges.

- Employee cardholders are only required to approve the expense report with out-of-pocket and personal charges.

- Yale Shared Services reviews expenses only for their clients.

- All reports are reviewed first by the 1K cost center approver.

- For amounts between 1K and 10K, expense reports are automatically routed to the appropriate level P2P Cost Center approver

- For amounts greater than 10K, expense reports are automatically routed to the appropriate level P2P Cost Center approver

- For amounts greater than 50K, expense reports are automatically routed to the

Controller for approval.

Note: Workday automatically informs the employee of the need to approve the expense report via a notification in his/her Workday inbox.

F. Expense Reimbursements or Deductions

Expenses are reimbursed or deducted in Workday. Transactions are posted to the financial statement.

Note: For further help with this process, please consult the Workday@Yale Support webpage or the Finance Support Center (FSC), (203) 432-5394.