We want to hear from you! Take the survey.

How do you use It’s Your Yale? How can it be improved? Answer for a chance to win Yale swag.

3501 PR.01 Payroll Costing

Revision Date:

August 30, 2022

Contents

5. Costing Hierarchy for Employer-Paid Expenses and Employee-Paid Deductions

8. Assigning Costing Allocations

9. Payroll Costing Validations

10. Costing Allocation Maintenance

13. Roles and Responsibilities

14. Workday Training References

Payroll Costing is the process in Workday that assigns charging instructions to earnings, deductions, expenses, and other payroll related journals.

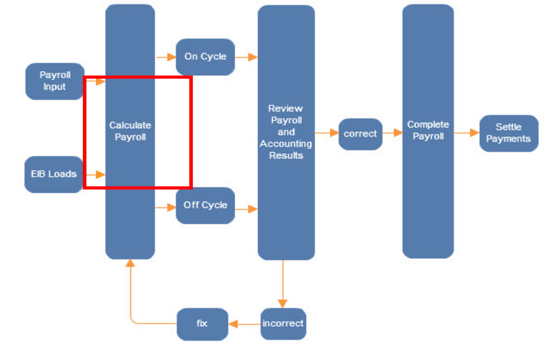

The Run Pay Accounting task is an integral part of the overall payroll process. During payroll calculation, costing allocations are used to distribute payroll costs to the appropriate charging instructions.

Workday automatically allocates certain payroll journals. Others can be reallocated. The chart below describes the different types of payroll costs and the associated allocation expectation.

|

Type of Payroll Costs |

Default Allocation |

Are allocations managed by the Department? |

|---|---|---|

|

Employee earnings belonging to the Adds to Gross or Adds to Net pay component group |

Allocated to the cost centers, projects, grants, and other organization types associated with the worker’s supervisory organization. |

Yes - The Cost Center Payroll Costing Specialist manages earnings through the Assign Costing Allocation task. |

|

Employer-paid expenses These are taxes and benefits that add to labor costs, but not to a worker’s gross or net pay. They are identified as additional pay components or in additional pay component groups for the run category. |

Charged to central costing allocations. |

No - Only central users can adjust the costing allocation for employer-paid expenses. |

|

Other deductions and net pay |

Charged to central costing allocations. Net pay is charged to the cost center of the worker; other worktags are central accounts. |

No - Only central users can adjust the costing allocation for employer-paid expenses. |

|

Fringe benefit expenses |

Based on the distribution of the worker’s gross pay earnings. |

No – Fringe is adjusted automatically when earnings are adjusted. |

|

Fringe benefit recovery |

Charged to central costing allocations. |

No – Fringe is adjusted automatically when earnings are adjusted. |

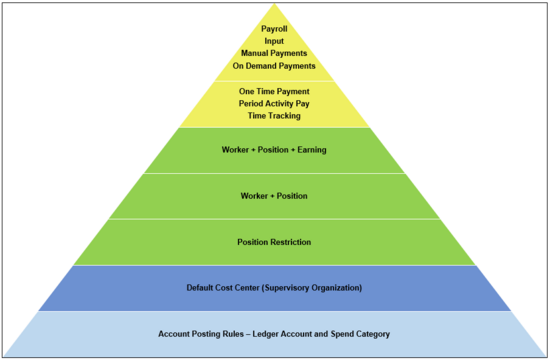

Within Workday, there is a payroll costing hierarchy. Costing for payroll can exist at several levels of the hierarchy. At Yale, the following levels are in use: Payroll Input, Worker Position Earning, Worker Position, Position Restriction, Position’s Supervisory Organization, Posting Rules Resulting Worktags (i.e., ledger account, spend category).

The levels of the hierarchy work in order, with Payroll Input overriding all levels below it, etc. A cost center is inherited from the Position’s Supervisory Organization; however, a cost center is not the full set of costing worktags needed for payroll.

If more than one set of costing allocations applies to an employee’s earnings, Workday applies the instructions in this sequence.

- Worktag overrides entered through payroll input, on demand payments, and manual payments.

- Payroll Input includes: Timesheet X

- Worktag values entered through Time Tracking or compensation (one-time payments and period activity payments).

- Worker position earning (specific earning for a worker).

- Worker’s position (all earnings for a worker’s position).

- Position restriction.

- Position’s supervisory organization (Default Cost Center).

- Posting Rules Resulting Worktags: Ledger Account and Spend Category only.

|

Hierarchy |

Information |

|

|---|---|---|

|

Payroll Input |

COA values are provided by external systems: Timesheet X or entered in the Payroll unit. |

Payroll input overrides any other costing allocation within the hierarchy. Covers students paid hourly and service and maintenance staff. |

|

Time Tracking, One Time Payments and Period Activity Pay |

COA values for One Time Payments and Period Activity Pay are provided when the request for payment is entered. In Time Tracking, the employee’s default costing information can be overridden, if necessary. The project is entered in the Time Type field and the remaining costing fields are added under details. For further guidance, refer to the Workday@Yale Time and Absence Resources. |

Input overrides any other costing allocation within the hierarchy. |

|

Worker Position Earning (Worker + Position + Earning) |

Costing allocations assigned by the Cost Center Payroll Costing Specialist. |

Provides exact COA segment allocations for a specific pay component paid to the worker for the selected position. Covers staff and faculty. |

|

Worker Position (Worker + Position) |

Costing allocations assigned by the Cost Center Payroll Costing Specialist. |

Provides exact COA segment allocations for the worker’s position. Costing allocations are assigned to all pay components for the worker unless specifically identified with a unique costing allocation at the pay component level (worker + position + earning). Covers staff and faculty. |

|

Position Restriction |

Costing allocations assigned by the Cost Center Payroll Costing Specialist. |

Current and future incumbent inherits the position restriction costing allocation. Position restriction will also show in My Worktags. Covers position management. |

|

Default Cost Center (Default Organizational Assignment) |

Inherited from the Supervisory Organization at the time of Hire or Change Organizational Assignment |

|

Costing for Employer-Paid Expenses and Employee-Paid Deductions is specific and managed centrally. These pay components should not be charged to the Worker’s costing overrides.

To account for changes in costing allocations throughout a pay period, mid-period costing is in use. Mid-period costing provides the ability to apply a costing allocation to any date within the pay period (for example, when a Grant ends on 1/15/21 and the pay period end date is 1/31/21).

When costing allocations change mid-period, Workday prorates costs for:

- Earnings based on the proration method (calendar days or days worked) of the earning.

- Earnings based on calendar days when a proration method isn’t specified for the earning or the earning is not setup to cause proration.

- Deductions for employer-paid expenses based on calendar days.

When Payroll passes costs to Workday Financials it also passes the end date of the costing allocation as the Budget Date. Changes to a worker’s default organization assignments do not cause costed earnings proration. Forward accruals use the costing allocations in effect on the period end date.

When costs are allocated across multiple organizations, and rounding is required, Workday calculates the last distribution, using the formula: Total Calculated Value of Pay Component - Sum of All Instances Prior to Final Instance =Final Distribution Amount. When payroll results that include earnings with associated override values (i.e., a specific costing allocation) are reversed, Workday uses the allocation instructions associated with the original results to process the reversal.

The Controller’s Office determines the pay components that will be assessed fringe. The pay components in the following list are current as of February 2021:

|

Earning |

||

|---|---|---|

|

Academic Administrative Compensation |

OT Shift Diff 15Pct |

Shift Premium Holiday |

|

Additional Compensation |

OT Shift Diff 2Pct |

Shift Premium Holiday OT |

|

Additional Regular MP Hours |

OT Shift Diff 5Pct |

Sick Hours Pay |

|

Additional Taxable Earnings |

OT Shift Diff 7Pct |

SM Doubletime |

|

Bereavement |

Overtime |

SM Injury |

|

Bonus Vacation Pay |

Overtime (Drama) |

SM Premium Lead Overtime Pay |

|

Chair Supplement |

Overtime Premium |

SM Premium Lead Pay |

|

Clinical Bonus |

Overtime Work in a Different Job Profile |

SM Premium Pay |

|

Compensatory Pay |

Paid Union Business |

Summer Compensation |

|

CT On Going Shift |

PDF Compensation |

Summer Programs Pay |

|

Department Paid WC |

Personal Time Pay |

Teaching |

|

Earned Floating Hol |

Recess Pay |

Time Entry Wage |

|

Emergency Closure Premium Pay |

Regular Salary |

Vacation Hours Pay |

|

Evening Shift |

Regular Salary Academic Pay |

Watch Engineer Premium |

|

Evening Shift Flat |

Regular Salary STD Offset |

Weekend Days |

|

Evening Shift Overtime |

Regular Wages |

Weekend Days Overtime |

|

Extra Compensation |

Retiree Casual Payment |

Weekend Double |

|

FAS Faculty Special |

Rotating Doubletime Premium |

Weekend Doubletime Premium |

|

Fellowship Teaching |

Rotating Overtime Premium |

Weekend Evenings |

|

Head of College Supplement |

Rotating Shift Premium |

Weekend Evenings Overtime |

|

Holiday Pay |

Salary Recovery (Inactive) |

Weekend Nights |

|

Holiday Recess Premium |

Salary Vacation Pay |

Weekend Nights Overtime |

|

Interim Assignment |

Second Job |

Weekend Overtime |

|

Jury Duty |

Second Job Overtime |

Weekend Time Entry Wage |

|

Lead Pay |

Shift Coordinator |

Work in a Different Job Profile |

|

Night Shift |

Shift Diff 10Pct |

Work in a Drama Casual Job Profile |

|

Night Shift Flat |

Shift Diff 15Pct |

YARC Emergency Close Overtime Pay |

|

Night Shift Overtime |

Shift Diff 2Pct |

YARC Emergency Close Pay |

|

On Call Pay Hourly |

Shift Diff 5Pct |

YSM FAC Incntv |

|

On Going Extra Comp |

Shift Diff 7Pct |

YTSS Work |

|

OT Shift Diff 10Pct |

Shift Prem Holiday Flat |

|

For information on fringe assessment rate(s), refer to the Controller’s Office Factsheet.

For fringe crosswalk to ledger account, refer to the COA page.

The Assign Costing Allocation task in Workday is used to manage Position Restriction, Worker Position and Worker Position Earning Level costing allocations. The Cost Center Payroll Costing Specialist performs this task. This task is completed routinely to maintain costing allocations and is performed as part of HCM business processes: Create Position, Hire, One Time Payment, Period Activity Pay, Request Leave of Absence (faculty only).

Costing Allocation updates sent to the Inbox through HCM business processes should be completed whenever possible. This includes skipping the task if the costing was already updated.

Position Restrictions

In HCM position management, a position restriction can be applied to ensure certain criteria is met during the hiring process. In addition to this information, there is an area to provide a payroll costing allocation that is specific to the position and carries forward with that position no matter the incumbent. A position restriction costing allocation provides a default costing allocation when no other costing allocation exists for the worker. Position restriction costing is managed by the Cost Center Payroll Costing Specialist. The Grant worktag cannot be used in a Position Restriction costing allocation.

Worker Plus Position

The Worker Position Level of the costing allocation hierarchy applies all costing allocation instructions only to the selected position and for all earnings, unless specifically allocated at the Worker Position Earning level.

Worker Plus Position Plus Earning

The Worker Position Earning Level of the costing allocation hierarchy applies all costing allocation instructions only to the selected earning for the selected position.

Earnings with Costing Allocations Assigned to Central University Accounts

The Pay Components in the following list have Costing Allocations assigned to Central University Accounts and should not be scheduled at the Worker Position Earning level:

|

Earning |

||

|---|---|---|

|

Adoption Reimbursement |

Prior Yr Fel Whldng Rfnd |

Special Pension |

|

Bonus Vacation Payout |

Prior Yr FICA Refund |

Stipend Tax Refund |

|

C&T Phased Retirement Plan |

Prior Yr FIT Refund |

Student Advance |

|

Fac Dep Child Award |

Prior Yr SIT Refund |

Tuition Reimb |

|

Fac Dep Child Care |

PriorYrStuStpnd Whld Rfnd |

Tuition Reimb Taxable |

|

Fac Phased Ret Plan |

Retiree Sick Pay |

Vacation Advance |

|

Fellowship Tax Refund |

Retirement Incentive |

Vacation Payout |

|

Health Rebate Taxable |

Salary Advance |

Wellness Incentive |

|

Homebuyer Benefit MENA |

Salary Continuation |

|

|

Payment Return |

Short Term Disblty |

|

Costing Allocation Information

- Costing allocation start and end dates cannot overlap past or future instructions.

- Workday displays new or copied allocations first.

- Attachments are not copied.

- The sum of all costing allocations entered for a single time-period must equal 100%.

- Costing allocations related to payrolls that have already processed should not be changed.

Ledger Account and Spend Category

The ledger accounts and spend categories used for payroll transactions are charged based on a set of Account Posting Rules. Account Posting Rules help to promote accurate distribution and reporting of expenses. Ledger accounts and spend categories are not entered when setting up the costing allocation.

Special Considerations – Academic Leave

When a faculty member is approved for an Academic Leave, the Cost Center Payroll Costing Specialist should adjust the payroll costing allocation to include the Additional Worktag, Costing Treatment >FacSabbatical. The FacSabbatical worktag should only be used for leave types that fall within the Academic Leave family, with some exceptions. The worktag cannot be added for the Leave Types of: Research Faculty Parental Leave, Public Service, Leave WO Salary, or Leave WO Yale Salary.

The FacSabbatical worktag will drive the ledger account and remove the fringe assessment for the allocation period. This worktag should not be used on an allocation that includes a Grant worktag even if the Grant is charged during the leave.

Special Considerations – Pension Cap

Employees whose salary exceeds the IRS pension cap (not to be confused with the sponsor imposed rate cap for grants and contracts), should use the additional worktag, Costing Treatment > PensionCap on the appropriate charging instruction lines. Use of the additional worktag will drive the ledger account and will apply the nominal 2% fringe assessment to the salary that exceeds the pension cap amount.

Special Considerations – VA Contracts

IPAs, identified through Yale Designated YD000377, need to be assessed fringe at the Grants and Contracts rate. For fringe to be applied correctly, all workers that have costing allocations that include YD000377 require an Additional Worktag. The Additional Worktag of Costing Treatment > VAContract, is entered and managed by the Cost Center Payroll Costing Specialist.

Workday Standard and Custom Validations

Workday validates new costing allocations and validates existing allocations when updated. The following custom validations help to ensure correct entry of payroll costing allocations. Critical warnings prevent the costing allocation from updating:

|

Severity |

Validations |

|---|---|

|

Critical |

|

|

Warning |

|

System-Generated Transaction Suspense

The program, PG99999, is used during the payroll accounting process when no other costing hierarchy is present for the worker. It is necessary to have full charging instructions during the payroll process to complete the process and produce a paycheck. All salary costs that have been charged to this program must be moved by the Cost Center Payroll Accounting Adjustment Specialist to the appropriate account.

Grant Start and End Date Validation

In addition to prospective costing allocation entries that validate on grant status and certain grant dates (see above), the Workday payroll process will validate on the current grant start and end dates (i.e., the grant start and end dates as of the system date). The Workday process ensures that the budget date of the payroll is between the Grant (Award Line) From Date and Grant (Award Line) To Date. If the payroll budget date falls outside of the date range, the worker’s Position Restriction or a central default account [i.e., PG99999] will be used. Costing Allocations should be maintained by the Cost Center Payroll Costing Specialist whenever the grant award line dates change and impact the validity of current and future costing allocation start and end dates. Reliance should not be made on the system to default the charging.

Non-Sponsored Payroll Accounting Adjustments (“PAAs”)

Non-sponsored PAAs are not permitted on original transactions older than 12 months. Adjustments to transactions impacting non-sponsored accounts that are older than 12 months route to the Controller’s Office for an exception. Requestors seeking such an exception must provide the following additional information:

- Detailed explanation as to why the PAA is needed;

- Plan to avoid the need for a PAA exception in the future; and

- Relevant, supporting documentation for the PAA.

Costing allocations for Workers must be continuously monitored to ensure proper charging of salary expenses. The following reports are available in Workday for monitoring:

- Find Workers Costing Allocations by Home Cost Center - Yale

- Find Position Restrictions Costing Allocations – Yale

Payroll obligations are covered in Procedure 3501 PR.03 Payroll Obligations. There are specific costing allocation maintenance tasks and HCM events that impact payroll obligations. Refer to the procedure for an overview of managing the payroll costing hierarchy for all active positions in the unit.

For additional information and frequently asked questions about Time Tracking, refer to the Workday@Yale Time and Absence Resources.

Cost Center Payroll Costing Specialist - responsible for keeping costing allocations for Earnings current; costing allocation are managed through the Assign Costing Allocation task. In addition, the Assign Costing Allocation task is a sub-process of certain HCM events. The Cost Center Payroll Costing Specialist also manages the task for those events.

Cost Center Payroll Accounting Adjustment Specialist - responsible for clearing any salary expenses that charged to PG99999 and other worktags if charged incorrectly.

Payroll Costing Manager – in Financial Systems & Solutions, is responsible for maintaining costing allocations for Employer-Paid Expenses and Employee-Paid Deductions as well as certain Earnings charged to central accounts. The Payroll Costing Manager corrects costing allocation errors during payroll processing and communicates the need to correct errors to the Cost Center Payroll Costing Specialist, as needed.

Payroll costing allocation references and training are available on the Workday@Yale Training website.