We want to hear from you! Take the survey.

How do you use It’s Your Yale? How can it be improved? Answer for a chance to win Yale swag.

4203 PR.01 Accounting for ITS Capital Projects

Revision Date:

June 28, 2017

Contents

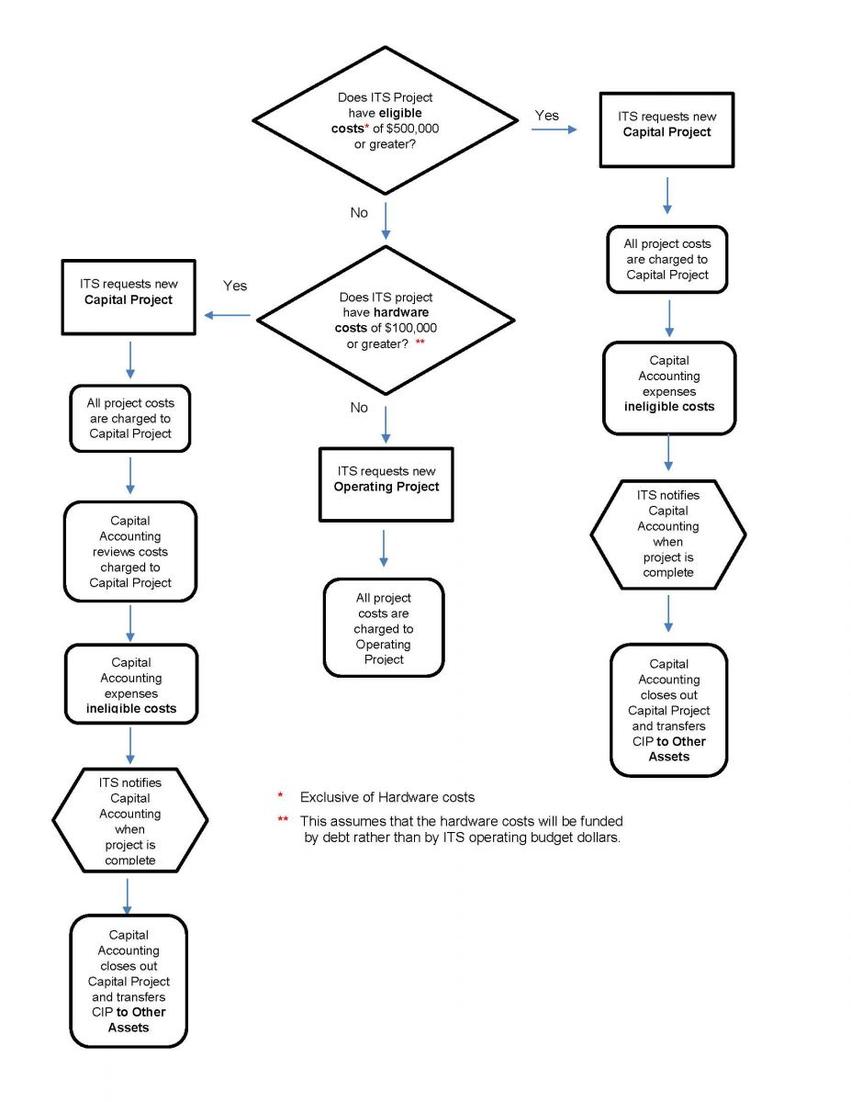

4. Decision Tree for Determining how to Account for ITS Internal Use Software Projects

5. Internal Use Software Capitalization Rates for ITS Personnel, by Role

Yale Policy 4203 and ASC 350-40 require that certain costs incurred in connection with the purchase or development of software for internal use be expensed and others capitalized, based on the nature of the costs and the stage of development during which they are incurred. At Yale, eligible costs will be capitalized when the total eligible costs of a project (excluding hardware costs) are $500,000 or greater. Costs incurred on projects to develop software for internal use in which total eligible costs are less than $500,000 must be expensed as incurred.

Eligible Costs – Eligible costs include external direct costs of materials and services, and any payroll and payroll related costs for Yale employees who are directly involved in a project to develop internal use software, to the extent their time was spent directly on the project. Eligible costs will be capitalized when they total $500,000 or more on a single software installation project.

A. Capitalization Threshold

The University’s capitalization threshold for Internal Use Software is $500,000, excluding the cost of hardware. This procedure sets forth the steps that must be followed to ensure the proper accounting for all ITS projects; those that meet the $500,000 capitalization threshold and those that do not.

The University’s capitalization threshold for computer hardware (equipment) is $5,000. This procedure also covers the procedures to be followed to ensure the proper accounting for computer hardware costs; those that meet the $5,000 capitalization threshold and those that do not.

B. Accounting for Internal Use Software Projects

Internal Use Software Projects that do not meet the capitalization threshold of $500,000

For an approved ITS project with total eligible costs (excluding hardware) less than $500,000, a new Operating Project must be requested from Chart of Accounts into which all project costs will be charged. All costs associated with the project will be expensed as incurred. This is accomplished by submitting a completed New Project Request Form to coa@yale.edu.

Internal Use Software Projects with eligible costs of $500,000 or greater (ITS Capital Projects)

For an approved ITS project where total eligible costs (excluding hardware) are expected to exceed $500,000, a new Capital Project must be requested from Capital Accounting.

All project costs incurred on an ITS project for which a Capital Project has been set up will be charged to the Capital Project. Ineligible costs (e.g. costs incurred during the Planning Phase or Post-Implementation Phase) will be expensed by the Capital Accountant in the Controller’s Office as part of the Workday Business Process covering Capital Assets.

Once an ITS Capital Project has been completed, ITS must notify Capital Accounting so that the project can be closed and the asset placed in service. The Capital Project will then be transferred from “Construction in Process” (CIP) to “Other Assets” and amortization of the asset will commence. In addition, Interest and Amortization (I&A) charges will be assessed using the mid-year convention in the year the asset was placed in service.

C. Accounting for Computer Hardware Costs

Many Internal Use Software projects have a computer hardware (equipment) component. When computer hardware (equipment) is purchased in connection with an approved ITS project, the costs should be charged according to the following procedures.

Operating Projects

When charged to an Operating Project, hardware costs in excess of Yale’s capitalization threshold for Moveable Equipment ($5,000) will be capitalized automatically, so long as they are charged to the proper Spend Category in Workday. The cost of the equipment will appear as a charge (i.e. an expense) in ITS’ operating statements. Such costs will be accounted for as Moveable Equipment, will be registered and issued an MEI tag, and will be included in “Equipment” in the University’s financial statements.

Capital Projects

There may be cases when ITS undertakes a Project that does not meet the threshold for capitalization of internally developed software ($500,000, exclusive of hardware costs), but has a significant hardware component (i.e. greater than $100,000). In those instances, if the Project will be funded by debt (rather than by the ITS Operating Budget), a Capital Project should be established to which ALL Project costs should be charged. The Capital Accountant will review the costs charged to the Capital Project. Hardware costs, and any other eligible costs (e.g. installation costs), will be capitalized as “Other Assets,” and all other project costs will be expensed.

As set forth in Policy 4203, Accounting for Internal Use Software Costs, Including Cloud-Based Computing Arrangements, and Business Process Reengineering, only costs incurred during the Application Development Stage are eligible for capitalization. Direct labor costs for those ITS employees (or contractors) working directly on the development and implementation of the software, to the extent of the time actually spent working directly on the project, may be capitalized.

Listed below is the capitalization rate to be used for ITS personnel (or contractors) by role:

|

Role |

Capital % |

|

Developer – software |

100% |

|

Developer – integration |

100% |

|

Tester |

100% |

|

Database Administrator |

100% |

|

Working Manager |

100% |

|

Technical Lead |

100% |

|

Business Analyst |

100% |

|

Configuration Analyst |

100% |

|

Senior Project Manager |

100% |

|

Report Developer |

100% |

No labor costs for any functional staff working on a project to develop internal use software may be capitalized nor may any labor costs for any personnel (ITS or functional) working in an administrative role.

Listed below are activities that are not capitalizable:

- Administrative

- Overhead

- Training

- Communication

- Change Management

- Web Editor

- Executive Sponsors

- Program Leadership